Impact of Inflation on Car Prices and Affordability

Analyze the effects of inflation on new and used car prices and overall affordability.

Impact of Inflation on Car Prices and Affordability

Understanding Inflation and Its Automotive Industry Effects

Hey everyone! Let's talk about something that's been hitting our wallets pretty hard lately: inflation. It's not just about the price of groceries or gas going up; it's significantly impacting the automotive industry, from the cost of a brand-new sedan to the price of a pre-owned SUV. When we talk about inflation, we're essentially referring to the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling. In simpler terms, your money doesn't buy as much as it used to. For car buyers, this means higher sticker prices, more expensive financing, and even increased costs for maintenance and insurance. This phenomenon isn't just a fleeting trend; it's a complex economic force with far-reaching consequences for both consumers and manufacturers in the US and Southeast Asian markets.

The automotive sector is particularly vulnerable to inflationary pressures due to its intricate global supply chains, reliance on raw materials, and significant labor costs. When the cost of steel, aluminum, semiconductors, or even shipping containers goes up, car manufacturers have to absorb these costs or, more commonly, pass them on to the consumer. This ripple effect can be seen in every segment of the market, from entry-level compacts to luxury vehicles. Understanding these dynamics is crucial for anyone looking to buy, sell, or even just maintain a vehicle in today's economic climate.

New Car Prices Navigating Inflationary Headwinds

So, what's happening with new car prices? Well, they've been on a pretty steep climb. Several factors contribute to this, all exacerbated by inflation. First off, manufacturing costs are up. We're talking about everything from the raw materials like steel, aluminum, and plastics to the complex electronic components, especially semiconductors. The global chip shortage, which started a few years back, really highlighted how dependent modern cars are on these tiny but crucial parts. When chip production couldn't keep up with demand, carmakers had to scale back production, leading to fewer cars on dealer lots. Basic economics tells us that when supply is low and demand is still relatively high, prices go up.

Beyond materials, labor costs are also rising. Factories need workers, and those workers need competitive wages, especially in an inflationary environment where their own cost of living is increasing. Energy costs, too, play a significant role. Running massive manufacturing plants, transporting vehicles, and powering dealerships all require substantial energy, and when oil and gas prices surge, those costs get baked into the final price of the car.

Let's look at some examples. In the US, popular models like the Honda CR-V or the Toyota RAV4, which were once considered affordable family SUVs, have seen their average transaction prices jump significantly over the past couple of years. A few years ago, you might have found a well-equipped CR-V for around $28,000; now, you're likely looking at $32,000 or more for a similar trim. The same goes for pickup trucks like the Ford F-150 or Chevrolet Silverado, which have always been big sellers. Their entry-level prices have crept up, making it harder for some buyers to afford them without stretching their budgets.

In Southeast Asia, the situation is similar, though often influenced by local taxes and import duties. Countries like Thailand, Indonesia, and Malaysia, which have strong domestic automotive industries, still face rising costs for imported components. For instance, a popular compact sedan like the Perodua Myvi in Malaysia or the Toyota Vios in Thailand, while still relatively affordable compared to Western markets, has also experienced price increases. These increases, even if seemingly small in absolute terms, can represent a larger percentage of a typical buyer's annual income in these regions, making new car ownership a more distant dream for many.

Another aspect is the shift towards more technologically advanced vehicles. Even entry-level cars now come with features like advanced driver-assistance systems (ADAS), larger infotainment screens, and more sophisticated powertrains. While these add value, they also add to the manufacturing cost, which is then passed on to the consumer. So, while you're getting more car for your money in terms of features, you're also paying a higher absolute price.

Used Car Market Dynamics and Inflationary Pressures

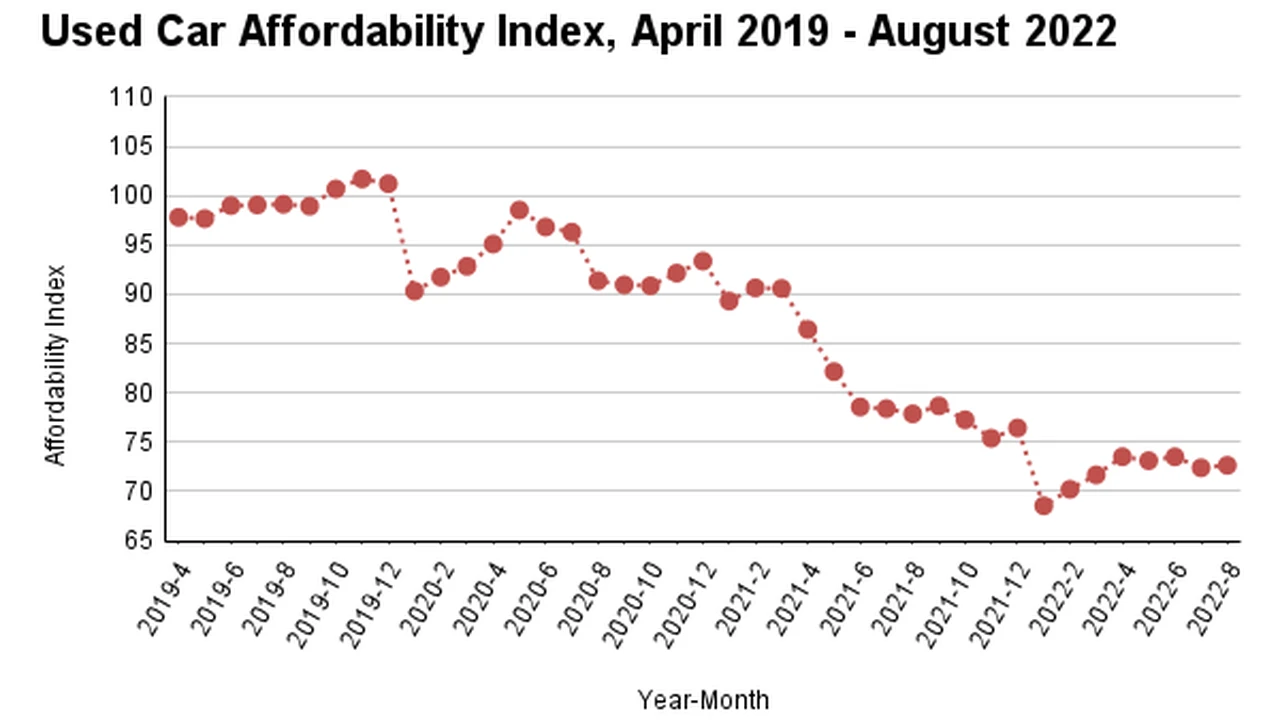

Now, let's pivot to the used car market, which has seen some truly wild swings. Historically, used cars were the more affordable alternative to new cars, depreciating steadily over time. However, the recent inflationary period, coupled with the new car supply shortages, completely flipped this dynamic on its head. With fewer new cars available, demand for used cars surged, driving their prices sky-high. For a while, some used cars were even selling for more than their original sticker price!

This phenomenon was particularly pronounced in the US. Popular used models like the Toyota Camry, Honda Civic, and even older SUVs like the Jeep Wrangler saw unprecedented price appreciation. A 3-year-old Camry, which would typically have lost 30-40% of its value, might have only depreciated by 10-15% or even less in some cases. This was great news for sellers but a nightmare for buyers, especially those on a tight budget or those who needed a car urgently.

The situation in Southeast Asia also reflected this trend, albeit with regional variations. In markets like the Philippines or Vietnam, where new car ownership can be quite expensive due to taxes, the used car market is always robust. When new car supplies dwindled, the demand for reliable used vehicles intensified, pushing prices up. Models like the Mitsubishi Xpander or the Honda City, which are popular family cars, saw their used prices hold strong, sometimes even appreciating for well-maintained units.

While the used car market has started to cool down a bit from its peak, prices are still elevated compared to pre-pandemic levels. This is partly because new car production hasn't fully caught up, and partly because the overall cost of living and doing business remains high. Dealers face higher costs for acquiring inventory, reconditioning vehicles, and even financing their operations, all of which contribute to the final price you see on the lot.

For consumers, this means that the traditional advantage of buying used – significant cost savings – has been somewhat eroded. It requires more careful budgeting and research to find a good deal. It also means that if you're selling a used car, you might still get a better price than you would have a few years ago, which can help offset the cost of your next vehicle.

Affordability Challenges and Consumer Strategies

So, with both new and used car prices soaring, affordability has become a major concern for many. It's not just the sticker price; it's the entire cost of ownership. Let's break down how inflation impacts overall affordability and what strategies consumers can employ.

Financing Costs and Interest Rates

One of the biggest hidden costs of inflation is its impact on interest rates. Central banks often raise interest rates to combat inflation, which directly translates to higher borrowing costs for consumers. If you're financing a car, even a small increase in the interest rate can add hundreds or even thousands of dollars to the total cost of the vehicle over the loan term. For example, a $30,000 car financed over 60 months at 3% interest costs about $540 per month. At 7% interest, that jumps to over $590 per month, adding over $3,000 to the total cost. This makes it harder for buyers to afford the monthly payments, even if the car's sticker price hasn't changed much.

Insurance Premiums and Maintenance Expenses

Inflation doesn't stop at the purchase price. Car insurance premiums have also been on the rise. This is due to several factors: the increased cost of repairing vehicles (parts and labor are more expensive), the higher value of cars (meaning bigger payouts for total losses), and a general increase in accident severity. Similarly, maintenance and repair costs are up. Parts are more expensive, and mechanics need to charge more to cover their own rising operational costs and wages. Even routine services like oil changes or tire rotations can cost more than they used to.

Fuel Costs and Operating Expenses

And let's not forget fuel! While not directly tied to car prices, fluctuating and often high fuel costs significantly impact the overall cost of owning and operating a vehicle. This is particularly relevant in regions like Southeast Asia, where fuel prices can be a substantial portion of a household's monthly budget.

Smart Strategies for Car Buyers in an Inflationary Market

Given these challenges, what can you do if you're in the market for a car? Here are some strategies to help you navigate the current landscape:

1. Consider Smaller, More Fuel-Efficient Vehicles

If you're looking to save money, downsizing might be a smart move. Smaller cars generally have lower sticker prices, better fuel economy, and often cheaper insurance premiums. For example, instead of a mid-size SUV, consider a compact SUV or even a well-equipped sedan. In the US, models like the Hyundai Kona (starting around $24,000) or the Kia Forte (starting around $20,000) offer excellent value. In Southeast Asia, the Perodua Axia (Malaysia, starting around RM 25,000) or the Suzuki Celerio (Philippines, starting around PHP 700,000) are great budget-friendly options that are also very fuel-efficient.

2. Explore Electric Vehicles (EVs) or Hybrids

While EVs often have a higher upfront cost, the long-term savings on fuel and maintenance can be substantial, especially with rising gas prices. Government incentives and tax credits for EVs can also help offset the initial purchase price. For example, the Chevrolet Bolt EV (US, starting around $27,000 before incentives) offers a great range for its price. In Southeast Asia, while EV adoption is still growing, models like the BYD Atto 3 (Thailand, starting around THB 1,199,900) are becoming more accessible and offer significant savings on running costs compared to gasoline cars.

3. Extend Your Current Vehicle's Lifespan

If your current car is still reliable, keeping it for a few more years can save you a lot of money. Invest in regular maintenance, address minor issues promptly, and follow the manufacturer's service schedule. This can defer the need for a new purchase until market conditions improve or you've saved up more. Think of it as maximizing your existing asset.

4. Shop Around for Financing and Insurance

Don't just accept the first financing offer you get from a dealership. Check with multiple banks, credit unions, and online lenders to find the best interest rate. Even a half-percentage point difference can save you hundreds over the life of the loan. The same goes for insurance; get quotes from several providers to ensure you're getting the most competitive rates for your coverage needs. Websites like NerdWallet or Bankrate in the US, or local comparison sites in Southeast Asia, can be incredibly helpful.

5. Consider Certified Pre-Owned (CPO) Vehicles

While used car prices are up, CPO vehicles can offer a good balance between cost savings and peace of mind. These cars are typically newer, have lower mileage, and come with a manufacturer-backed warranty, reducing the risk associated with buying a used car. They often bridge the gap between a new car's reliability and a used car's price point. Popular CPO programs include those from Toyota, Honda, and Ford, offering models like the Toyota Corolla CPO or Honda Civic CPO, which are known for their reliability.

6. Be Flexible with Features and Trim Levels

Do you really need the top-tier trim with all the bells and whistles? Often, stepping down one or two trim levels can significantly reduce the price without sacrificing essential features. Prioritize what's truly important to you and be willing to compromise on luxury add-ons. For example, a base model Subaru Crosstrek (US, starting around $25,000) still offers excellent AWD and safety features, even if it lacks leather seats or a premium sound system.

7. Negotiate Smartly and Be Patient

While negotiation room might be tighter in a high-demand market, it's always worth trying. Do your research on fair market prices for the specific vehicle you're interested in. Be prepared to walk away if the deal isn't right. Sometimes, waiting a few weeks or months can lead to better inventory and potentially better prices as market conditions fluctuate. Patience can be a virtue in this environment.

The Future Outlook for Car Prices and Affordability

Predicting the future is always tricky, but economists and automotive analysts are constantly trying to gauge where car prices and affordability are headed. Many expect that while the extreme price surges of the past few years might moderate, we're unlikely to return to pre-pandemic price levels anytime soon. The underlying inflationary pressures, coupled with ongoing supply chain challenges and the increasing cost of integrating new technologies (especially for EVs), suggest that car prices will remain elevated.

However, as new car production slowly catches up and interest rates potentially stabilize or even decrease in the long run, we might see some relief. The used car market is already showing signs of cooling, which is good news for buyers. The shift towards electric vehicles will also continue to influence pricing, with battery costs being a key factor. As battery technology improves and production scales up, the cost of EVs could become more competitive, further impacting the overall market.

For consumers in both the US and Southeast Asia, staying informed about market trends, being proactive in their research, and adopting smart buying strategies will be essential. The automotive landscape is constantly evolving, and understanding the impact of inflation is a critical part of making informed decisions about one of the biggest purchases many people make.

Ultimately, while inflation has certainly made car ownership more challenging, it's not impossible. By being strategic, flexible, and well-informed, you can still find a vehicle that meets your needs and fits your budget. Happy car hunting!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)