Top 4 Automotive Investment Opportunities

Identify the top four investment opportunities within the dynamic automotive sector.

Identify the top four investment opportunities within the dynamic automotive sector.

Top 4 Automotive Investment Opportunities

The automotive industry is a colossal and ever-evolving beast, constantly reshaped by technological advancements, shifting consumer preferences, and global economic forces. For savvy investors, this dynamic landscape presents a wealth of opportunities, but also significant challenges. Navigating this complex terrain requires a keen understanding of emerging trends, disruptive technologies, and the companies best positioned to capitalize on them. This article delves into four key areas within the automotive sector that offer compelling investment prospects, providing a detailed look at the underlying drivers, key players, and potential returns.

Electric Vehicles EV Revolution Investment Opportunities

The shift from internal combustion engines (ICE) to electric vehicles (EVs) is arguably the most significant transformation the automotive industry has seen in a century. This isn't just about new cars; it's about an entirely new ecosystem encompassing battery technology, charging infrastructure, raw materials, and even energy grids. The momentum is undeniable, driven by environmental concerns, government incentives, and improving EV performance and affordability. For investors, the EV revolution offers multiple entry points.

EV Manufacturers Investment Analysis

Investing directly in EV manufacturers is the most obvious route. While Tesla (TSLA) remains the dominant force, its valuation often reflects significant future growth. However, traditional automakers are rapidly catching up, investing billions in their EV transitions. Companies like General Motors (GM) and Ford (F) are aggressively launching new EV models, leveraging their existing manufacturing capabilities and brand recognition. In Southeast Asia, local players and Chinese brands are making significant inroads. For instance, VinFast (VFS) from Vietnam has made a bold entry into the global market, while BYD (1211.HK) from China is a global powerhouse in EV production, including batteries. When evaluating EV manufacturers, consider their production capacity, battery supply chain security, software capabilities, and global expansion plans. Look for companies with a clear roadmap to profitability in their EV divisions, not just ambitious sales targets.

Battery Technology and Raw Materials Investment Prospects

The heart of every EV is its battery. As such, companies involved in battery production and the mining of critical raw materials like lithium, cobalt, and nickel are crucial. Companies like Contemporary Amperex Technology Co. Limited (CATL) in China and LG Energy Solution (373220.KS) in South Korea are global leaders in battery manufacturing. Investing in these companies offers exposure to the fundamental component driving EV adoption. Furthermore, the demand for raw materials is skyrocketing. Companies like Albemarle (ALB) for lithium or Glencore (GLEN.L) for cobalt and nickel are direct beneficiaries. However, this segment comes with geopolitical risks and commodity price volatility. Diversification across different materials and regions can mitigate some of these risks.

EV Charging Infrastructure Investment Growth

The widespread adoption of EVs hinges on a robust and accessible charging infrastructure. This segment is still in its nascent stages but is poised for explosive growth. Companies like ChargePoint (CHPT) and EVgo (EVGO) in the US are building out public charging networks. In Southeast Asia, companies like Greenlots (acquired by Shell) and local energy providers are expanding their networks. Investment opportunities exist in companies that manufacture charging stations, develop charging software, or operate charging networks. Consider companies with strong partnerships, scalable technology, and a clear path to profitability through subscription models or energy sales. The long-term growth potential here is immense, as charging infrastructure is a critical bottleneck that needs to be addressed for mass EV adoption.

Autonomous Driving Technology ADAS Investment Potential

Autonomous driving, or self-driving technology, promises to revolutionize transportation, making it safer, more efficient, and more accessible. While fully autonomous vehicles (Level 5) are still some years away, advanced driver-assistance systems (ADAS) are already commonplace, laying the groundwork for future autonomy. This sector is characterized by intense research and development, significant capital expenditure, and complex regulatory hurdles.

ADAS and Sensor Technology Investment Opportunities

The building blocks of autonomous driving are sensors (cameras, radar, lidar, ultrasonic), sophisticated software, and powerful computing platforms. Companies specializing in these components are prime investment targets. Mobileye (MBLY), an Intel company, is a leader in computer vision for ADAS. Luminar Technologies (LAZR) is a prominent player in lidar technology, which is crucial for high-level autonomy. Nvidia (NVDA) provides the high-performance computing platforms necessary to process the vast amounts of data generated by autonomous vehicles. When investing in this space, look for companies with proprietary technology, strong intellectual property, and established partnerships with major automakers. The competitive landscape is fierce, so differentiation and a clear path to commercialization are key.

Autonomous Software and AI Development Investment Prospects

Beyond hardware, the software and artificial intelligence (AI) that enable autonomous driving are equally critical. Companies developing the algorithms for perception, prediction, planning, and control are at the forefront of this revolution. Waymo (a subsidiary of Alphabet, GOOGL) and Cruise (a subsidiary of General Motors, GM) are leading the charge in developing full self-driving systems. While direct investment in these private entities might be challenging, exposure can be gained through their parent companies. Additionally, companies developing AI chips and software tools for autonomous driving, such as Qualcomm (QCOM) with its Snapdragon Ride platform, offer indirect investment opportunities. The complexity of autonomous software development means that companies with deep expertise and significant R&D budgets are likely to emerge as leaders.

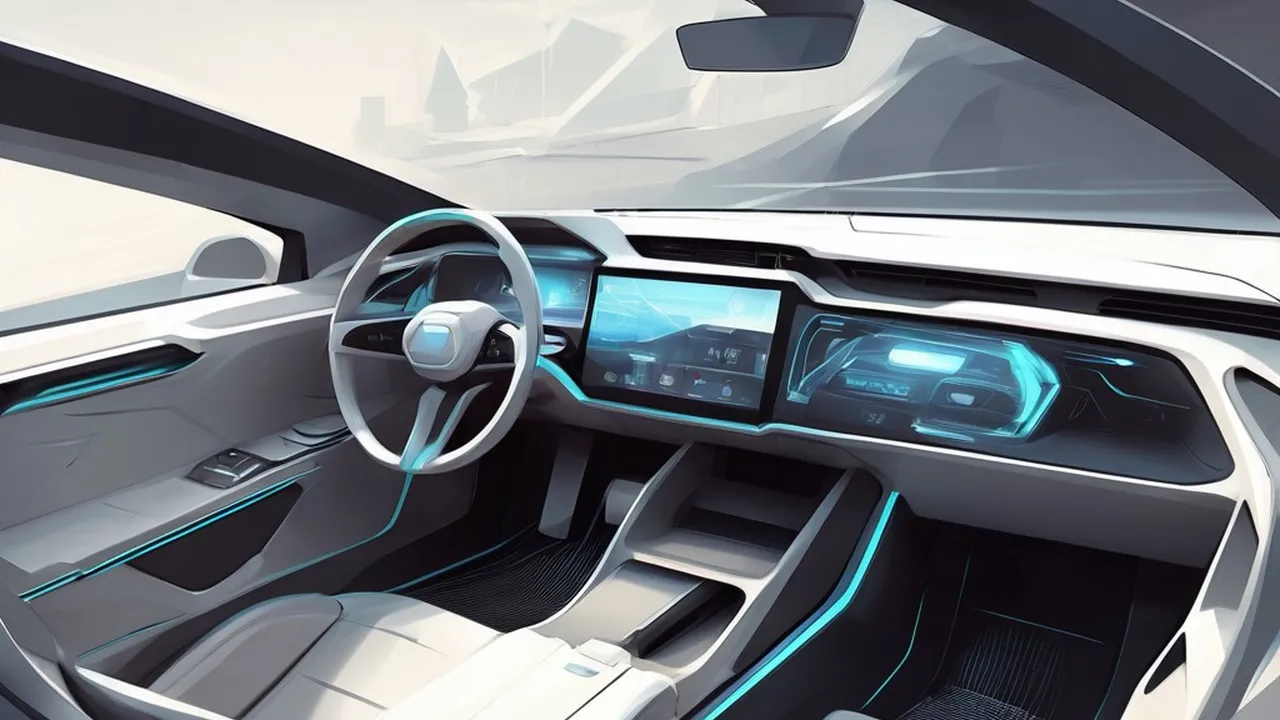

Automotive Software and Connectivity Investment Trends

Modern vehicles are increasingly becoming sophisticated computers on wheels, driven by software and connectivity. This trend, often referred to as the 'software-defined vehicle,' opens up new revenue streams and investment opportunities beyond traditional hardware sales. From infotainment systems to over-the-air (OTA) updates and subscription services, software is becoming a key differentiator.

In Vehicle Infotainment and User Experience UX Investment

Consumers now expect seamless integration of their digital lives into their cars. This drives demand for advanced infotainment systems, intuitive user interfaces, and robust connectivity. Companies like Harman International (a Samsung subsidiary) are major players in automotive audio and infotainment. Apple (AAPL) and Google (GOOGL) are also deeply embedded with CarPlay and Android Auto, respectively. Investment opportunities exist in companies that develop the underlying software platforms, provide connectivity solutions (e.g., 5G modules), or create compelling in-car applications. Look for companies that can deliver a superior user experience and integrate seamlessly with other digital ecosystems.

Over The Air OTA Updates and Subscription Services Investment

OTA updates allow automakers to improve vehicle performance, add new features, and fix bugs remotely, much like a smartphone. This capability is transforming the ownership experience and creating new revenue streams through subscription services for features like enhanced navigation, performance upgrades, or even heated seats. Tesla pioneered this model, and traditional automakers are rapidly adopting it. Companies that provide the technology for OTA updates, such as Aptiv (APTV) or BlackBerry (BB) with its QNX operating system, are well-positioned. Furthermore, companies that can successfully monetize these subscription services will see recurring revenue, which is highly attractive to investors. This shift towards software-driven features and services represents a significant long-term growth area for the automotive industry.

Automotive Aftermarket and Services Investment Outlook

While much attention is given to new vehicle sales and cutting-edge technology, the automotive aftermarket – encompassing parts, accessories, maintenance, and repair services – is a massive and resilient sector. It often provides a more stable investment profile, as vehicles, regardless of their age or technology, require ongoing maintenance.

Automotive Parts and Components Suppliers Investment

The aftermarket for parts and components is vast, covering everything from tires and brakes to filters and electronic modules. Companies like Advance Auto Parts (AAP) and AutoZone (AZO) are major retailers in the US, while numerous manufacturers supply these parts globally. In Southeast Asia, local distributors and manufacturers play a crucial role. Investing in established parts suppliers can offer exposure to a steady demand stream, as vehicles on the road require replacement parts throughout their lifespan. Look for companies with strong distribution networks, diverse product portfolios, and efficient supply chains. The transition to EVs will also create new aftermarket opportunities for EV-specific parts and services.

Vehicle Maintenance and Repair Services Investment Growth

Every vehicle needs maintenance and occasional repairs. This creates a consistent demand for service centers, independent mechanics, and specialized repair shops. While many of these are small, privately owned businesses, larger chains and franchises offer investment opportunities. Companies like Monro (MNRO) operate networks of automotive service centers. Furthermore, the increasing complexity of modern vehicles, especially EVs and those with ADAS, requires specialized diagnostic tools and trained technicians, creating a niche for companies that provide these services or training. The stability of this sector, driven by the sheer number of vehicles in operation, makes it an attractive option for long-term investors.

Automotive Insurance and Financial Services Investment

The automotive ecosystem also includes a significant financial services component, particularly insurance and financing. As vehicles become more expensive and technologically advanced, the demand for comprehensive insurance coverage and flexible financing options grows. Companies like Progressive (PGR) and Geico (a Berkshire Hathaway subsidiary, BRK.A) are major players in the US auto insurance market. In Southeast Asia, local insurance providers and banks offer similar services. Investment opportunities exist in insurance companies that are adapting to new risks associated with EVs and autonomous vehicles, or in financial institutions that specialize in automotive lending. The recurring revenue nature of insurance premiums and loan repayments can provide a stable income stream for investors.

The automotive industry is a dynamic and complex sector, offering a multitude of investment opportunities across various segments. From the revolutionary shift to electric vehicles and autonomous driving to the steady demand in the aftermarket and financial services, investors have diverse avenues to explore. Success hinges on thorough research, understanding the underlying technological and market trends, and identifying companies with strong fundamentals, innovative strategies, and robust leadership. As the industry continues its rapid evolution, staying informed and adaptable will be key to capitalizing on these exciting prospects.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)